Payroll calculator georgia

Calculate your total income taxes. All Services Backed by Tax Guarantee.

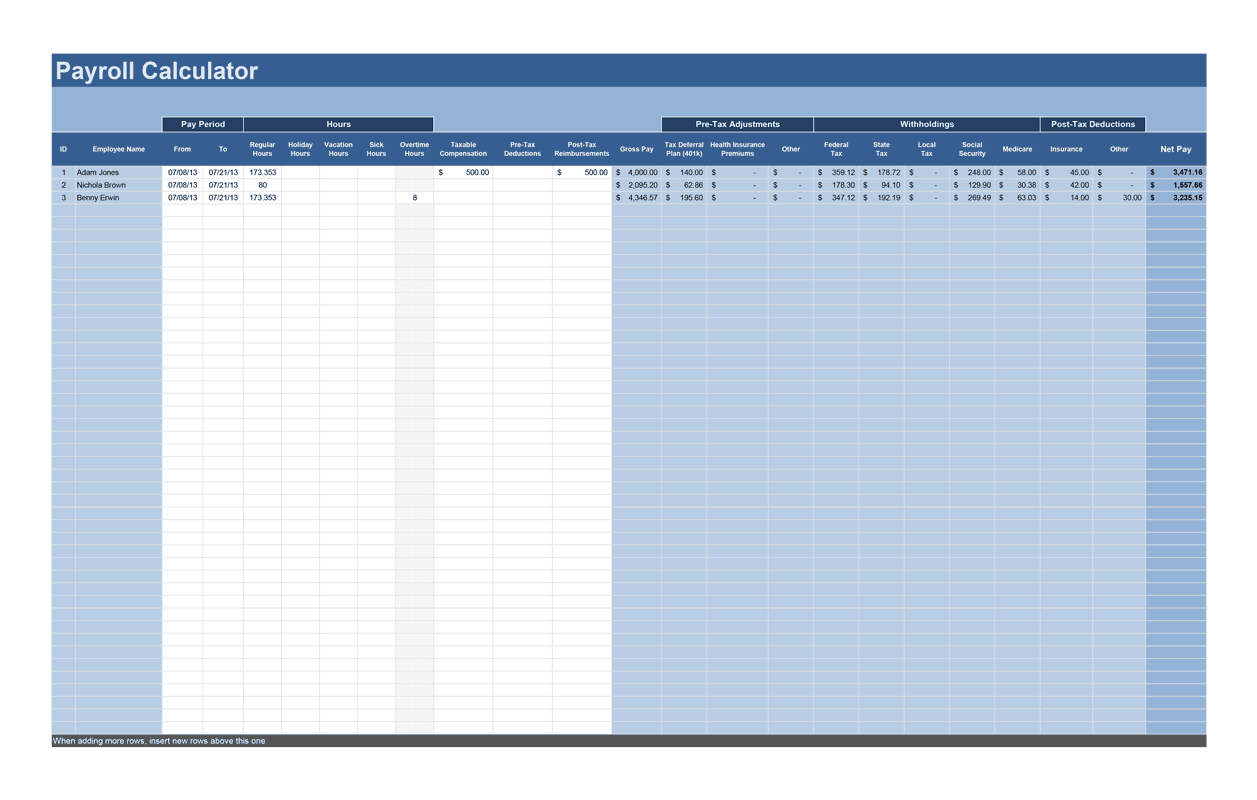

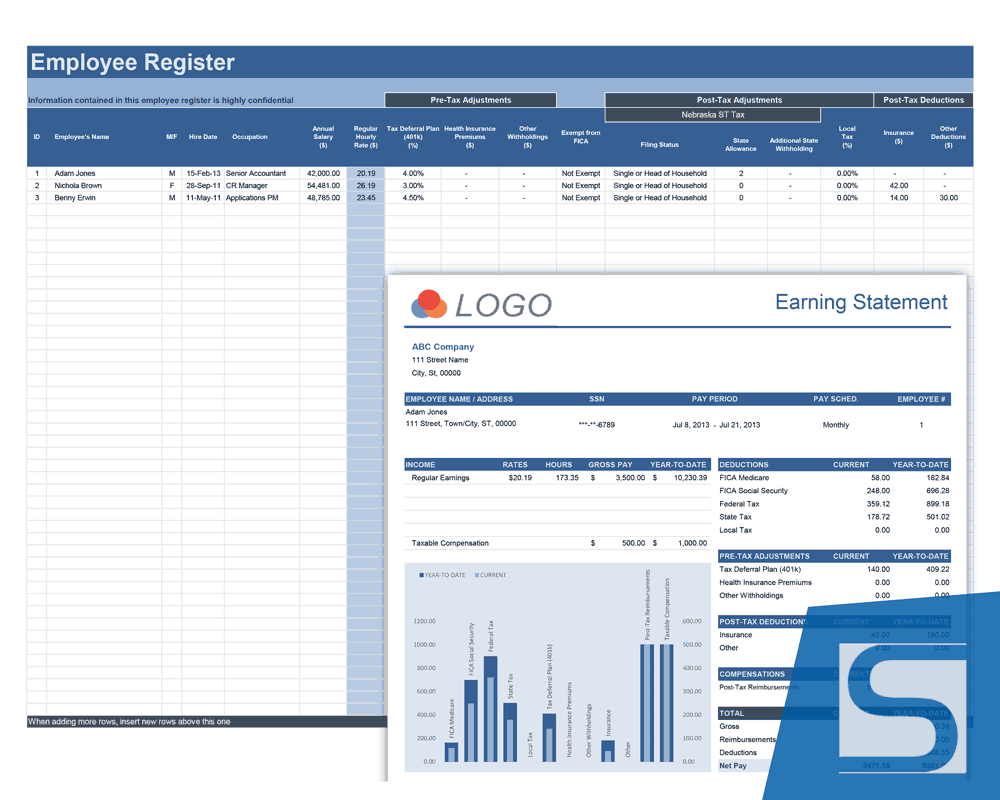

Payroll Calculator Free Employee Payroll Template For Excel

Georgia Paycheck Calculator - SmartAsset SmartAssets Georgia paycheck calculator shows your hourly and salary income after federal state and local taxes.

. Updated for 2022 tax year. Figure out your filing status work out your adjusted gross income. The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs.

Get Started With ADP Payroll. Indoor water parks in pa. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Ad Compare This Years Top 5 Free Payroll Software. Ad Compare This Years Top 5 Free Payroll Software. Your 401k plan account might be your best tool for creating a secure retirement.

Georgia Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Well do the math for youall you need to do is enter. Get Started With ADP Payroll.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Register as an employer on the Georgia Employment. Free Unbiased Reviews Top Picks.

The average calculator gross salary in Atlanta Georgia is 37311 or an equivalent hourly rate of 18. Customize using your filing status. This is 4 lower -1392 than the average calculator salary in the United.

Your average tax rate is. Payroll Tax Salary Paycheck Calculator Georgia Paycheck Calculator Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Ad Payroll So Easy You Can Set It Up Run It Yourself.

For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross. Use this Georgia gross pay calculator to gross up wages based on net pay. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator.

Federal Georgia taxes FICA and state payroll tax. Use the Georgia paycheck calculators to see the taxes on your paycheck. Calculate your total income taxes.

Free Unbiased Reviews Top Picks. Ad Process Payroll Faster Easier With ADP Payroll. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck.

The Salary Calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the percentage of your salary that. Updated for 2022 tax year. Plug in the amount of money youd like to take home.

If you make 55000 a year living in the region of Georgia USA you will be taxed 11755. The loan program you choose can affect the interest rate and total monthly payment. In the field Number of Payroll Payments Per Year enter 1.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia. That means that your net pay will be 43245 per year or 3604 per month. The tax calculator will automatically calculate the.

You only pay taxes on. Simply enter their federal and state W-4 information as. In the income box labelled 1 enter the annual salary of 10000000.

For example if an employee earns 1500 per week the individuals annual. All you have to do. Georgia Income Tax Calculator - SmartAsset Find out how much youll pay in Georgia state income taxes given your annual income.

Enter your info to see your. Ad Process Payroll Faster Easier With ADP Payroll. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull.

6 types of acne. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia. Risk of perforation with colonoscopy. This Georgia 401k calculator helps you plan for the future.

Prime Cost Calculation Great Article On How How Food And Labor Costs Are Calculated Food Cost Restaurant Management Food Truck

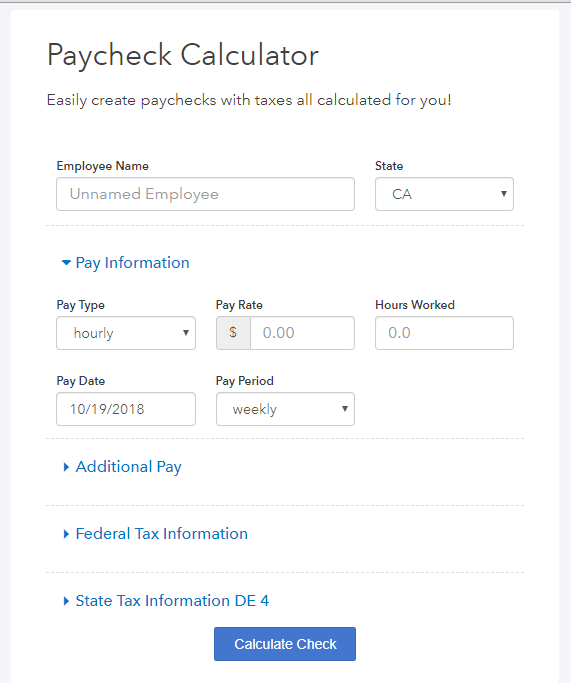

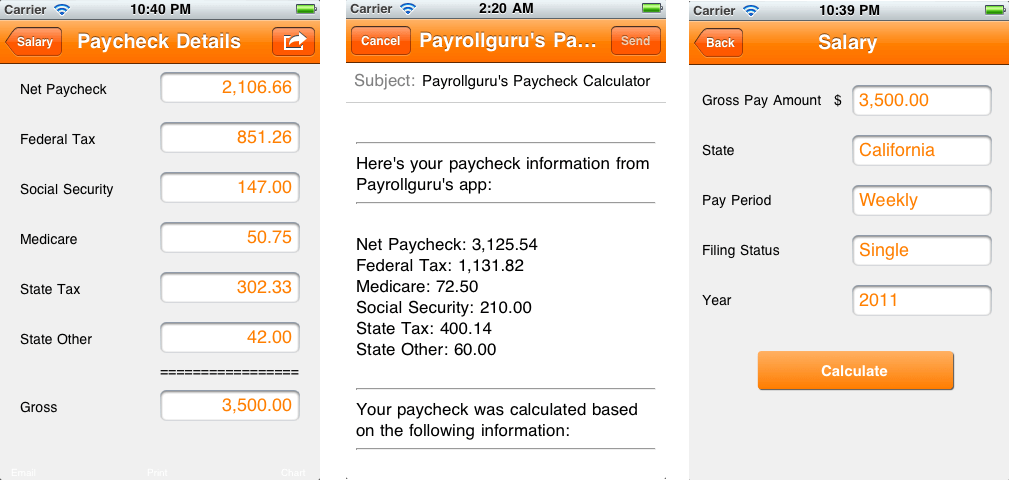

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Reliable Support From A Qualified Accountancy Firm In London Services Business Services Tax Advisers Payroll C Certified Accountant Accounting Payroll

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Paycheck Calculator Take Home Pay Calculator

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Payroll Calculator Free Employee Payroll Template For Excel

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

Free Corporation Tax Filing With Accounting Package Available At Abacconsulting Taxation Tax Accounting Account Filing Taxes Income Tax Income Tax Return

Payroll Calculator Free Employee Payroll Template For Excel

Georgia Paycheck Calculator Smartasset

Calculation Free Vector Icons Designed By Icon Pond Free Icons Vector Icon Design Web App Design

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp